If you are not living under a rock, I guess you already heard about Venture Capital (VC).

What is Venture Capital?

Venture Capital is an investment models, of which wealthy Limited Partners give their money (a lot of money) to professional investors (aka General Partner) to not only invest in high risk - high return startups, but accelerate them to growth in a period of 5-10 years.

Startups are high-risk business, so VC never put their bet in a single startup. Venture Capitals put their bet in industries and do their best to minimize risks so their Limited Partners’ money is relatively safe.

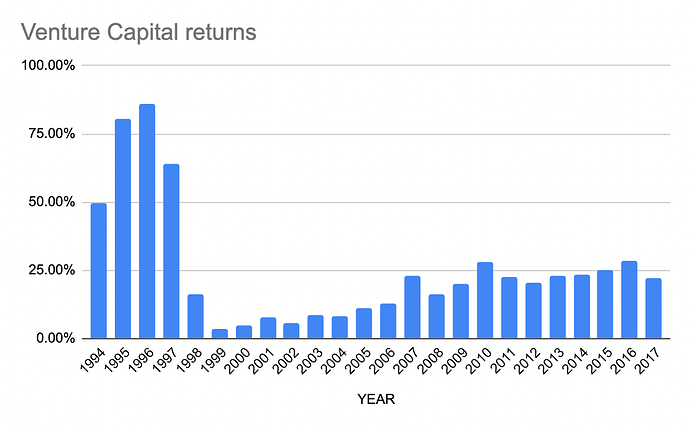

From our research, from the period from 1994 to 2017, VC consistently give investors more than 20% ROI per year.

There is a problem with it

Venture Capital only bring more money to the already rich. There is nothing wrong with it. However, it limit the capability to raise fund and limit the number of people (aka social capital) actually support the projects once invested.

What is Hectagon’s play book?

Hectagon is built by senior Venture Capitalist and it is going to repeat the Venture Capital model with a small change: selling $HECTA to public to raise fund (instead of going to wealthy partners only) and benefit all $HECTA holders along the way.

Hey, but retail investors’ money is short term.

There are arguments that retail investors always want to cash out as quick as possible and it would collapse the protocol before it could do any meaningful investment. This risk is valid. However, Hectagon teams provide both technology and data at its best so retail investors can make a good choice with their money. Investment is not a zero sum game, if you give money enough time then it can give you wealth.